Housing Development Finance Corporation Limited (HDFC) Bank is one of India’s largest private banks in the corporate banking sector. HDFC was set up in 1994 after getting approval from the Reserve Bank of India (RBI) as a private sector bank. The headquarters of this banking and financial service provider company is currently in Mumbai.

The major financial and banking services of HDFC Bank include Retail Banking, Wholesale Banking, and Treasury. The bank is a subsidiary of the HDFC group. Some other subsidiary services of the group are HDFC Securities, Mutual Fund, HDFC Life, HDFC ERGO, Pension, and HDB Financial Services.

| Notice - Be alert! Don't share the financial or banking details and don't share OTP to customer care executive. Protect yourself from Frauds and Scams. Report to Cyber Crime Bureau or Call 1930 as soon as possible to protect your earnings and others. |

| INDEX |

Want to complain about HDFC banking services? To file your complaint, use the grievance redressal mechanism of HDFC Bank. In the early stage, you should call the toll-free customer care number, e-mail, or may lodge an online complaint to the customer representatives. Still dissatisfied or unresolved issues? Escalate the complaint to the grievance officer or higher authority of the bank.

Some major issues of the HDFC banking services that can be resolved are:

- Banking Services:

- Report the issues with banking accounts, digital banking services, or net banking.

- Concerns with deposits, safe banking, and mobile banking (SME digital, MyCards, UPI, etc.)

- Matters of personal, current, and business (corporate) banking services.

- Any matters related to credit card, remittances, and overseas (international) transactions (Forex)

- Payment (Money):

- Concerns about money transfers via UPI, IMPS, RTGS, NEFT, CardPay, etc.

- The issues related to HDFC cards (debit/credit), bill payments, recharge, or payment solutions

- Report problems with HDFC payment solutions like PAYZAPP, FASTag, taxes, payment gateways, etc.

- Bank Accounts:

- Issues with saving, salary, current, or rural bank accounts.

- Complaints related to deposits (RD/FD), safe deposit lockers, pension funds, or high-net-worth banking

- Investment:

- Report the concerns of Demat/Trading account, bonds & securities, Mutual Funds, or NPS.

- Loans:

- Complaints about Personal, Home/Vehicle, Rural, or Business Loan

- Issues with Flexi pay (buy now, pay later), loan against assets (god, properties, MF), or other types of loans

- Matters related to Emergency Credit Line Facility (ECLF), PMAY-U loans, Government Sponsored Programs, and professional (business) loans

- Insurance:

- Complaints regarding the Life, Health & Accident, and Vehicle insurance of HDFC

- Matters pertaining to travel, cyber, and other insurance policies

- Some government flagship programs like APS, PM-JJBY (Jeevan Jyoti Bima Yojana), or PM-SBY (Suraksha Bima Yojana)

- Others:

- Report issues pertaining to banking services and other subsidiary financial services offered by HDFC Bank.

In basic terms, the grievance resolution process of the HDFC bank involves 3 levels (according to the grievance redressal policy). In level 1, customers may directly file a complaint to the customer care representatives or register an online complaint. If not resolved or dissatisfied with the final resolution, escalate the complaint to level 2 (grievance officer).

Yet not satisfied or unresolved? Again, escalate the grievance to the Nodal or Principal Nodal Officer, HDFC Bank at level 3 with facts and the unique reference/ticker number of the previous complaint. Still dissatisfied? Unresolved complaints? Approach the banking Ombudsman of the HDFC, appointed by the Reserve Bank of India (RBI)

Have banking complaints not been resolved within 30 days by HDFC? Don’t be intense, you should file a complaint against HDFC Bank with the Banking Ombudsman of the Reserve Bank of India(RBI). Customers may also opt for the dispute resolution process by mediation with HDFC Bank.

Further, for the complaints of quality of consumer services, stock market & securities, insurance, pension, housing loans, etc., approach the respective regulatory bodies or tribunals like NCDRC (Consumer Commission), SEBI, IRDAI, PFRDA, NHB, etc.

How to File a Complaint with HDFC Bank (Housing Development Finance Corporation Limited)?

The most common reason for unsatisfied or unresolved complaints related to the services of HDFC Bank is the lack of knowledge about the grievance redressal mechanism. Many customers face this problem. But, the resolution process is well defined in the citizen charter of the bank.

HDFC Bank: Complaint Registration Fee and Resolution Time:

| Registration Fee | No Charges (₹0) |

| Resolution Time | 30 days (as per the grievance redressal policy of the bank) |

| Refund Period | Within 3 to 7 working days (As per the RBI guidelines) |

According to the grievance redressal policy of HDFC Bank, the resolution process is divided into 3 levels. If the submitted complaints are not resolved within the resolution period or the customer is dissatisfied with the final response, escalate the appointed officer to the next level.

Assigned Time by HDFC Bank for Various Banking Services & Transactions:

| Banking Transactions | Time taken |

|---|---|

| Cash deposits at the teller counter | Up to 5 min. |

| Cash withdrawals at the teller counter | Up to 5 min. |

| To issue a demand draft or Manager’s cheque | 7 to 10 min. |

| Payment of Manager’s cheque or demand draft | 7 to 10 min. |

| For the redemption of a fixed deposit | 5 min. |

| Opening of a new bank account | 10 to 15 min. |

| For Collection of Cheques: | |

| (1) Local (Branch) | As per clearing house rules |

| (2) Outstation Drawn on Branch locations | 7 to 14 days (depending on the location) |

| (3) Non-branch location (at correspondent bank tie-up) | Maximum 14 working days |

| (4) Non-branch location (non-correspondent bank) | Maximum 14 working days |

| (5) Foreign cheques | 2 to 16 international working days (from value date) |

| Fund transfer | Up to one day |

*Note – These time norms for the banking transaction are indicative and may vary upon the volume handled by the branches based on the location or peak/non-peak periods in the bank.

The banking & financial issues include payment (transactions), bank accounts, insurance, money deposits, investment, and digital banking (UPI). Many other complaints can also be submitted to the authorized officer of the HDFC Bank.

The Levels to Resolve a Banking Complaint:

- Level 1:

- Submit your complaint by calling a customer care representative or online form.

- Dial the toll-free customer care number (helpline), e-mail your concerns, or visit your nearest HDFC branch office

- File an online complaint via the online grievance portal, chat with the executive (Eva), or write to the branch manager.

- If not resolved within 10 working days, escalate to level 2.

- Level 2:

- Escalate grievance to Grievance Redressal Officer of Grievance Redressal Cell (GRC), HDFC Bank with previous unique complaint reference number (CRN).

- Submit your concerns via e-mail, or contact number, or write a grievance letter to the regional GRO, HDFC Bank.

- It will take up to 10 working days to get a final response. If not received within this period, escalate the complaint to level 3.

- Level 3:

- File the unresolved or unsatisfactory complaint with the Nodal/Principal Nodal Officer, HDFC Bank

- Approach the officers by contact number, e-mail, or writing a letter to the official address.

- Wait up to 10 working days to get a final resolution.

- Unresolved or dissatisfied with the resolution? Finally, approach the Banking Ombudsman.

Banking Ombudsman:

If your complaints submitted to HDFC Bank are not resolved within 30 working days, you should file a complaint about the banking issue to Banking Ombudsman with some required information regarding previously submitted complaints. Alternatively, you may also opt for an internal Ombudsman of HDFC Bank to resolve your disputes.

Note – Do the grievances belong to a Demat account (stocks & securities), insurance, pension, or other than banking services? Approach respective regulatory bodies like SEBI, PFRDA, IRDAI, etc.

HDFC Bank Customer Care Number

The fastest way to register a complaint about unauthorized transactions, banking issues, and other technical or internet banking is to call HDFC Bank customer care representatives. According to the citizen charter, the toll-free helpline and HDFC customer number are provided to banking clients including corporate (business) clients.

Provide the following details to resolve your complaints:

- Name of the complainant

- The subject of the issue

- A brief description of the banking complaint

- Supporting proof, facts, or evidence (if required)

Note – Don’t share any personal, sensitive, or financially critical information including OTP with the customer representatives of the bank even to any official members.

For emergency and urgent banking matters like:

- Unauthorized e-transactions (transactions not done by you)

- Block/Unblock credit/debit card

- Digital lending & banking products

- Credit card mis-spelling or harassment

- Demat Account & trading services

Report instantly by calling the dedicated agents via HDFC Bank toll-free number. After the successful submission of each complaint, don’t forget to take or note down the reference number or unique complaint number (ID). This will be very useful to track the status and to escalate the concerns to higher authorities of the bank.

HDFC Bank customer care number, helplines, and contact details to file a complaint with concerned departments.

| HDFC | Customer Care Number |

|---|---|

| HDFC Bank complaint number | 18002583838 |

| HDFC Bank toll-free helpline number | 18002026161, 18602676161 |

| WhatsApp number | +917070022222 |

| HDFC abroad traveler customer care | +912261606160 |

| Mutual Fund customer care number | 18002671006 |

| Helpline Number for Local Banking | +919426792001 |

| Contact your regional HDFC branch | Click Here |

Need help with other banking disputes? Approach:

- Call the dedicated HDFC customer care number +912261717606 for complaints related to Imperia Account, Diners Black Credit Card, and Infinia Credit.

- For any unauthorized transactions and PayZapp, call the number 18001029426 or e-mail cybercell@payzapp.in with the transaction issues.

- For concerns and complaints related to HDFC Credit Card’s misleading sales, fraud, or harassment, call on 18002583838 or e-mail salesqueriescards@hdfcbank.com with the issue.

Need more information about unauthorized transactions? Read the consumer protection policy of HDFC Bank for electronic banking transactions and know the liabilities of the Bank towards registered customers & account holders of the bank.

Note – Is it not resolved within 10 working days? Dissatisfied with the final response? You should escalate the complaint with the reference number to the Grievance Redressal Officer (GRO) of HDFC Bank.

Alternatively, customers may directly visit the nearest branch or write a grievance letter to your regional branch manager of HDFC Bank

HDFC NRI (International) Banking Helpline Number

Are you an NRI (Non-Resident Indian) customer of HDFC Bank? If the complaints about the existing bank account holders (NRI), phone banking, or need assistance to open an NRI account, call the toll-free helpline number of HDFC Bank. The customer care executives or authorized officers will resolve your banking issues.

| Country (NRI PhoneBanking Number) | Customer care number |

|---|---|

| For Existing HDFC Account Holders (24×7) | |

| USA (United States) | 8559996061 |

| Canada | 8559996061 |

| Singapore | 8001012850 |

| Kenya | 0800721740 |

| Other countries | +912267606161 |

| NRI Account (HDFC Bank) Opening Assistance (Toll-free Number) | |

| USA (United States) | 8552078106 |

| Canada | 8558463731 |

| UK (United Kingdom) | 8007562993 |

| Singapore | 8001012798 |

| Other countries | Click here to receive a call |

Need more information about NRI services? Read the NRI banking services of HDFC Bank to resolve issues.

Note – Yet not satisfied with the final response? Escalate the disputed grievance to the regional Grievance Officer or branch manager of the head office, of HDFC Bank.

Merchants Customer Care Number (HDFC Bank)

Have complaints about merchant services, business, or banking? You should file a complaint with the Merchant Department of HDFC Bank. The issues can be POS terminal, Payment settlement, merchant account, or Payment gateway.

Ready to complain? Report the concerns by calling the customer care number (helpline), e-mailing, or contacting the respective branches of the bank. If not satisfied with the resolution, e-mail merchantsupport@hdfcbank.com with some required information.

- In short, for the regions of Chennai, Delhi & NCR, Gujarat, Karnataka, Maharashtra, Mumbai, Telangana, and West Bengal, dial the merchant customer care number (STD) 60017000 (add the STD code of your region)

- For the regions of Andhra Pradesh, Bihar & Jharkhand, Coimbatore, Goa, Haryana, J&K, Kerala, Madhya Pradesh & Chhattisgarh, Odisha, Punjab, Rajasthan, Uttar Pradesh & Uttaranchal, dial the number (STD) 6001700 (add the STD code of your region)

- If merchant customers belong to North East states, dial the HDFC helpdesk number 9333557000 to raise your concerns.

HDFC Bank Merchant services customer care number to lodge your complaint:

| Region (State) | HDFC Merchant Complaint Number (Helpdesk) |

|---|---|

| Andhra Pradesh | +918916001700 |

| Bihar | +916576001700 |

| Chennai | +914460017000 |

| Coimbatore | +914226001700 |

| Delhi & NCR | +911160017000 |

| Goa | +918326001700 |

| Gujarat | +917960017000 |

| Jharkhand | +916576001700 |

| Karnataka | +918060017000 |

| Kerala | +914846001700 |

| Kolkata | +913360017000 |

| Madhya Pradesh & Chattisgarh | +917316001700 |

| Maharashtra | +912060017000 |

| Mumbai | +912260017000 |

| North East | +919333557000 |

| Odisha | +916746001700 |

| Punjab, Haryana, J&K | +911726001700 |

| Rajasthan | +911416001700 |

| Telangana | +914060017000 |

| Uttar Pradesh & Uttarakhand | +915626001700 |

Note – Not satisfied with the final resolution? Are complaints yet not resolved? Escalate the complaint by e-mail to the Merchant Service Manager of HDFC Bank (Helpdesk manager) of your region at level 2.

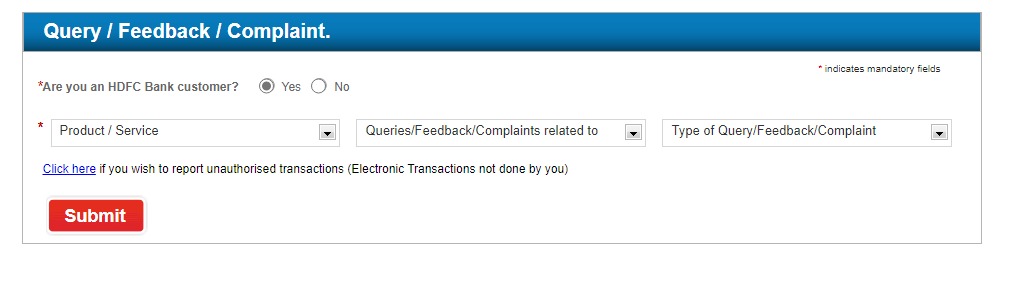

File an Online Complaint

The transparent way for filing a banking complaint is online mode. HDFC Bank has provided chat facilities, an online dispute resolution mechanism, and e-mail. So, you can write your concerns with your banking issues like net banking, transaction failures, personal/corporate banking, and other services & products of the bank.

Must mention the following details:

- Name of the complainant and customer ID

- The type of issue

- Description of the complaint with the required information to identify the issue

- Share evidence, proof, or documents (if required)

- Note – Don’t share any financially sensitive information to protect yourself from scams or fraud.

After submission of your online complaint, note down the complaint reference number (CRN). Use this CRN number to track the status and further, to escalate the unresolved or unsatisfactory dispute.

Details to lodge a banking complaint online to the respective department of HDFC Bank:

| HDFC Bank | File a complaint online |

|---|---|

| HDFC online dispute resolution | File a complaint |

| E-mail (Webform) | Click to Email |

| Unauthorized banking e-transactions | Report online |

| Block or unblock credit card | Click Here |

| Contact the banking officials | View/Contact |

| HDFC Bank offline forms | View/Download |

Note – Not resolved within 10 working days or dissatisfied with the final response? Feeling unhappy! Don’t worry, escalate this complaint to the Grievance Redressal Officer (GRO) of the Cell, HDFC Bank. Further, you may approach the Nodal Officer.

Alternative Ways:

| Twitter Support | @HDFCBank_Cares |

| HDFC.bank | |

| Mobile App (HDFC) | Andriod | iOS |

Tips – For complaints of quality of services or violation of consumer rights, file a complaint with the National Consumer Helpline (NCH), Ministry of Consumer Affairs.

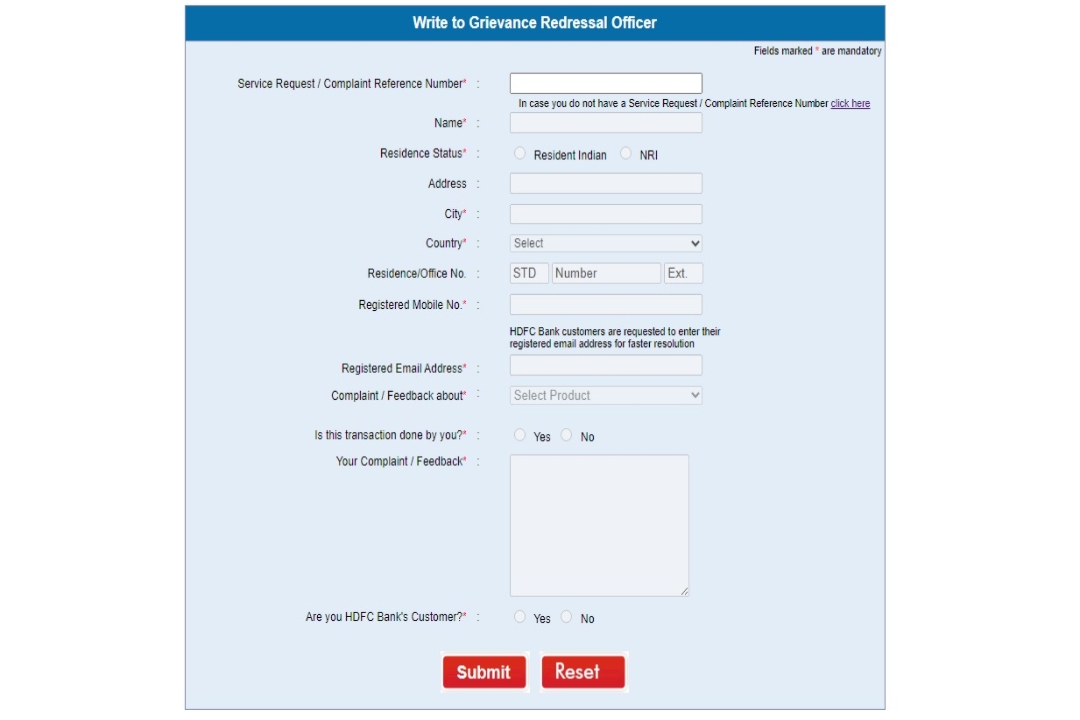

Grievance Officer, HDFC Bank

According to the HDFC Bank grievance redressal policy and citizen charter of the bank, the Grievance Redressal Cell (GRC), HDFC Bank is the authorized office where unresolved or unsatisfactory complaints can be escalated.

Escalate the complaint to the appointed Grievance Redressal Officer of GRC, if:

- Submitted complaints (by Retail branches, Phone banking, or Website (online) & Net Banking in level 1) are not resolved within 10 working days.

- Dissatisfied with the final response/resolution delivered by the officials.

- Complaints against the behavior of branch managers or staff/employees of HDFC Bank.

The mode of lodging a grievance can be online as well as offline. You may write a letter to your regional GRO of the Grievance Cell, e-mail your disputes, or fill out and submit an online grievance form from the bank. The resolution time of this level is 10 working days, if exceeds this, escalate the dispute to the next authorized officer.

Must Provide the Following Information to GRC:

- Service request or customer reference number (CRN) of the previous complaint

- Name and communication details

- Type of complaint/query

- A detailed description of the issue or reason for dissatisfaction

- Response to the previous complaint (if have one)

- Attach supporting documents, images, or evidence as proof (if required)

After writing your grievance letter or filling out the online form, send it to the official address of the Grievance Cell, HDFC Bank, or submit your form online. In last, note down the reference number to track the status. If not satisfied with the response, use this number to escalate the dispute to Nodal Officer.

Contact details and address of the Grievance Redressal Cell (GRC) of HDFC Bank to lodge a grievance:

| Designation | Grievance Redressal Officer, GRC (HDFC Bank) |

| Phone No. | 18002664060 (Banking Products), +914461084900 (Credit Cards) |

| E-mail your dispute | Click to Email |

| Contact officials (GRO) | Click Here |

Note – Law Enforcement Agency (LEA) of the government may e-mail LEA.Communication@hdfcbank.com the respective Department of HDFC Bank to seek information related to the inquiry or for investigations.

1. For Disputes about Banking Products and Depository Services, Write to:

| Address: Grievance Redressal Officer, HDFC Bank Grievance Redressal Cell, HDFC Bank Limited, 1st Floor, Empire Plaza – 1, Lal Bahadur Shastri Marg, Chandan Nagar, Vikroli West, Mumbai – 400083. Phone No: 18002664060 |

2. For Matters of Credit Card specific complaints, Write to:

| Address: Grievance Redressal Officer, HDFC Bank (Chennai), HDFC Bank Cards Division, 8, Lattice Bridge Road, Thiruvanmiyur, Chennai 600041. Phone No: +914461084900 |

Note – The call facilities will be not available on bank holidays. Always prefer to e-mail or lodge your grievance online by filling out the form.

Still, dissatisfied with the final response? Have your complaints not been resolved within 10 working days? Worried! In level 3, you should escalate the disputed case to the Nodal Officer of your region or the Principal Nodal Officer (PNO), HDFC Bank.

HDFC Demat Account: Lodge a Complaint

Have issues with the Demat account? Yes! Lodge a complaint about the stock market & securities services of HDFC Bank that include Demat account services, DP charges, depository services, stocks management, CDSL or NSDL, etc. with the respective officer of the HDFC Securities.

The escalation matrix within HDFC Bank (Securities) for the complaints related to the Demant account involves:

- Level 1: Customer care or client servicing (use HDFC toll-free numbers)

- Level 2: Head of customer care/client servicing of Grievance Redressal Cell (GRC)

- Level 3: Compliance Officer, HDFC Bank Ltd. (Demat & trade wing)

If not satisfied with the final response, you may lodge a complaint with NSDL (National Securities Depository Limited), CDSL, or SEBI (Securities and Exchange Board of India).

Escalation Matrix: Demat account customer care number, e-mail, and other official contact details of HDFC Securities:

| Officers, HDFC Bank (Securities) | Contact details (only for Demat account) |

|---|---|

| Customer care/Client servicing | Customer Care No: 18002026161, 18602676161, +912261606160 (NRI) E-mail: dphelp@hdfcbank.com Address: Client Services Department, HDFC Bank Ltd. Empire Plaza – I, 1st Floor, LBS Marg, Chandan Nagar, Vikhroli (West), Mumbai – 400083. |

| Head of customer care / Client servicing | Phone No: 18002664060 Email: grievance.redressal@hdfcbank.com Address: Grievance Redressal Cell, HDFC Bank Limited, 1st Floor, Empire Plaza – 1, Lal Bahadur Shastri Marg, Chandan Nagar, Vikhroli West, Mumbai – 400083. |

| Compliance Officer | Phone No: +912233839212 Address: HDFC Bank Ltd. Trade World “A” Wing, 2nd Floor, Kamala Mills, Senapati Bapat Marg, Lower Parel, Mumbai – 400013. |

| CEO, HDFC Bank | Phone No: +912266521002 Email: managingdirector@hdfcbank.com Address: HDFC Bank House, Dr. Annie Besant Rd, Worli, Mumbai – 400018. |

Note – Not satisfied with the final resolution? You may file a complaint with the SCORES of the Securities and Exchange Board of India (SEBI). For more information, read the escalation matrix for the Demat account of HDFC Bank.

Principal Nodal Officer, HDFC Bank

By following the guidelines of the Banking Ombudsman Scheme 2006, HDFC Bank has appointed state-wise Nodal Bank Officers and a Principal Nodal Officer at the Corporate Office of the Bank.

If the submitted complaints are not resolved by Grievance Redressal Cell within 10 working days, escalate the unresolved or unsatisfactory complaints to the Nodal Officer of your state and further to the Principal Nodal Officer (PNO) of the bank.

Mention the following details:

- Service request or CRN (complaint reference number)

- Name, e-mail, and communication details

- The subject of the unsatisfactory/unresolved complaint

- Description of the issue with the reason for dissatisfaction (if received a response)

- Attach supporting documents, images, or proof of evidence (if available)

Submit the written complaint letter by post or e-mail your concerns to the Nodal Officer of your region. You may also call the respective officers to report the disputed case.

Contact With Nodal Officers

Official contact details of Principal Nodal Officers, HDFC Bank Limited to lodge a complaint:

| Designation | Principal Nodal Officer (PNO), HDFC Bank |

| Phone No: | +912262841505 |

| File complain online | |

| Address | Principal Nodal Officer for HDFC Bank Ltd., HDFC Bank Ltd. 5th Floor, Tower B, Peninsula Business Park, Lower Parel West, Mumbai 400013. |

Customers or clients may also contact or submit their complaints to the appointed Nodal Officers of respective states. The official communication details to raise your concerns are mentioned below.

Contact Details of State-Wise Nodal Officers, HDFC Bank Limited:

| State & Region | Contact Nodal Officer, HDFC Bank |

|---|---|

| Andhra Pradesh and Telangana | Phone No: +914067921327 Address: Nodal Officer, HDFC Bank Ltd, 8th Floor, HDFC Bank House, Road No.1, Banjara Hills, Hyderabad – 500034. |

| Assam, Arunachal Pradesh, Manipur, Meghalaya, Mizoram, Nagaland, and Tripura | Phone No: +913344065165 Address: Nodal Officer, HDFC Bank Ltd. Jardine House, 4 Clive Row, Kolkata – 700001. |

| Bihar | Phone No: 18002026161, 18602676161 (Banking) Address: Nodal Officer, HDFC Bank Ltd, Crosswindz, 41, Kutchery Road Near Shaheed Chowk Ranchi- 834001 Jharkhand. |

| Chhattisgarh | Phone No: 18502676161 (Rest of Madhya Pradesh/ Chhattisgarh), 18602676161 (Indore) Address: Nodal Officer, HDFC Bank Ltd, Plot No. Z-1, Asha Avenue Building, MP Nagar Zone -1, Bhopal-462011 (M.P). |

| New Delhi | Phone No: 18002026161 (Banking) New Delhi-I Address: Nodal Officer, HDFC Bank House, Vatika Atrium, A – Block, Golf Course Road, Sector 53, Gurgaon – 122002. New Delhi-II Address: Nodal Officer, HDFC Bank House, Vatika Atrium, A – Block, Golf Course Road, Sector 53, Gurgaon-122002. |

| Gujarat, Union Territories of Dadra and Nagar Haveli, Daman, and Diu | Phone No: +917966630428, +917961606161 (Banking) Address: Nodal Officer, HDFC Bank House, Opp. Navrangpura Jain Temple, Navrangpura, Ahmedabad – 380009. |

| Haryana (except Panchkula, Yamuna Nagar, and Ambala), Ghaziabad, and Gautam Budh Nagar (UP) | Phone No: +918130306083, 18602676161 (Banking) Address: Nodal Officer, HDFC Bank House, Vatika Atrium, A – Block, Golf Course Road, Sector 53, Gurgaon – 122002. |

| Himachal Pradesh, Punjab, Chandigarh (UT), Panchkula, Yamuna Nagar, and Ambala (Haryana) | Phone No: +911724125133 Address: Nodal Officer, HDFC Bank Ltd, Plot No I – 15, Sector 101, Alpha IT City, Mohali-160062. |

| Jammu and Kashmir | Phone No: +918130306083, 18602676161 (Banking) Address: Nodal Officer, HDFC Bank House, Vatika Atrium, A – Block, Golf Course Road, Sector 53, Gurgaon – 122002. |

| Jharkhand | Phone No: 18002026161 Address: Nodal Officer, HDFC Bank Ltd, Crosswindz, 41, Kutchery Road Near Shaheed Chowk Ranchi- 834001 Jharkhand. |

| Karnataka | Phone No: 18602676161 Address: Nodal Officer, HDFC Bank Ltd, First floor, 103/31, 26th Main Road, 4th T Block, Jayanagar, Near SSMRV College, Bangalore – 560041. |

| Kerala, Lakshadweep, and Puducherry (only Mahe Region) | Phone No: +914714253303 Address: Nodal Officer, HDFC Bank Ltd, Cordial Residency Towers, Opposite Kurups Lane, Sasthamangalam, Thiruvananthapuram – 695010. |

| Madhya Pradesh | Phone No: 18002026161 (Banking) Address: Nodal Officer, HDFC Bank Ltd, Plot No. Z-1, Asha Avenue Building, MP Nagar Zone -1, Bhopal -462011 (M.P). |

| Districts of Mumbai, Mumbai Suburban, and Thane | Phone No: +912224811081 Address: HDFC Bank Ltd, 5th Floor, Tower B, Peninsula Business Park, Lower Parel West, Mumbai 400013. |

| Maharashtra (except Mumbai & Thane) and Goa | Phone No: +912224811082 Address: Nodal Officer, HDFC Bank Ltd, 5th Floor, Tower B, Peninsula Business Park, Lower Parel West, Mumbai-400013. |

| Odisha | Phone No: +913344065165 Address: Nodal Officer, HDFC Bank Ltd. Jardine House, 4 Clive Row, Kolkata – 700001. |

| Rajasthan | Phone No: +911412353326 Address: Nodal Officer, HDFC Bank Ltd, A-8 Hanuman Nagar (A) Jaipur – 302021, Rajasthan. |

| Tamil Nadu, Puducherry (except Mahe), and Andaman and Nicobar Islands | Phone No: +914428616424 Address: Nodal Officer, HDFC Bank Ltd., Prince Kushal Towers, First Floor, A Wing, 96, Anna Salai, Chennai – 600002. |

| Uttar Pradesh (excluding NCR regions) | Phone No: +915226160616 Address: Nodal Officer, HDFC Bank, 2nd Floor, Pranay Towers, 38 Darbari Lal Sharma Marg, Near Pratibha Cinema, Lucknow, Area Pin Code-226001. |

| Uttarakhand and Saharanpur, Shamli, Muzaffarnagar, Baghpat, Meerut, Bijnor, and Amroha (Uttar Pradesh) | Phone No: 18602676161 (Banking) Address: Nodal Officer, HDFC Bank, 2nd Floor, Pranay Towers, 38 Darbari Lal Sharma Marg, Near Pratibha Cinema, Lucknow-226001. |

| West Bengal and Sikkim | Phone No: +913344065165 Address: Nodal Officer, HDFC Bank Ltd. Jardine House, 4 Clive Row, Kolkata – 700001. |

Have queries about Nodal Officers? Contact the Nodal Officers (call) of your region and raise your concerns.

Note – Are you not satisfied with the final resolution? Is it not resolved within 30 working days (including levels 1, 2, and 3)? Don’t worry! File a complaint with the Banking Ombudsman, RBI (Reserve Bank of India). If you desire, opt for the Internal Ombudsman of HDFC Bank.

Banking Ombudsman, RBI

According to the Integrated Ombudsman Scheme, 2021 under the Banking Regulation Act, 1949, the Reserve Bank of India has appointed Banking Ombudsman whom citizens can approach if the submitted complaints are not resolved by the respective banks within 30 working days.

Have you not been satisfied with the final resolution of HDFC Bank? In this condition, file a complaint with Banking Ombudsman, RBI against HDFC Bank Limited with appropriate information and facts. Remember, the submitted disputed case will be resolved as per the guidelines of RBI. For more details, visit the link below:

Click: File an online complaint with Banking Ombudsman, RBI

Must provide these details to the Ombudsman:

- Name of the complainant and contact details

- Reference/CRN of previous complaints submitted to HDFC Bank

- The subject of the banking issue

- Response from respective Nodal Officers (if any)

- Reason for dissatisfaction (if received final response)

- A detailed description of the disputed case with the bank

- Attach supporting documents, images, or other proof (if required)

To raise your disputed concerns with the Ombudsman, visit the above link and lodge an online complaint by following the given instructions.

Have complaints about other financial services like Insurance, Pension, etc.? Approach these regulatory bodies or tribunals (for disputes with HDFC Bank) as mentioned below:

- PFRDA (Pension Fund Regulatory and Development Authority)

- Ombudsman, IRDAI (Insurance Regulatory and Development Authority of India)

- NHB, National Housing Bank

Tips – Still dissatisfied with the final order of the Ombudsman? Take legal advice from a legal expert in the financial field for further action. After taking advice, you may approach respective tribunals, judicial bodies, or apex courts.

Resolve these banking issues

Some banking and financial issues that are defined in the grievance redressal policy of HDFC Bank and can be resolved by submitting a complaint, are:

- Report the service deficiency or error with offering any banking service

- Non-conformance in the financial products

- To resolve a banking dispute that may include services of the Bank

- Facing any form of protest, grumble, accusation, or objection with the bank

- Delayed to provide services or products of the bank beyond the given time or TAT, that can be:

- Request for changes or updation (address or account details), but not done

- Issues with HDFC Insta account activation

- Credit not received even after depositing the cheque (exceeds settlement period)

- Delayed for closure of the account

- Pension not disbursed on time

- Other issues with the delivery of products or banking services

- Any dispute or issues with online payment & transactions, like:

- Unauthorized electronic transactions carried out by POS, ATM transactions carried out through Credit or Debit Card of the bank

- The disputes of transactions by Net Banking, UPI (Unified Payment Interface), PayZapp, etc.

- Any payment or banking transactions claimed as not done by the customer

- Disputes related to Google Pay as PSP (Payment Service Provider)

- Concerns with delay in credit of card payment or any transacted amount

- Claims to have received abusive, harsh, or misbehavior calls from the HDFC Bank

- Disputes on EMI (insurance, loan, credit, etc.), ROI, Tenor, Loan amount, or auto payments

- Any allegation related to insurance selling by misleading guidance or without disclosure of terms and conditions

- Other complaints about the bank staff behavior, corruption (demanding bribes), or unethical behavior of branch managers or employees of HDFC Bank.

Frequently Asked Questions about HDFC Bank

Q. What is the toll-free customer care number of HDFC Bank?

A. Dial the toll-free complaint numbers 18002583838, 18002026161, or 18602676161 to raise your concerns with HDFC Bank representatives. You may also WhatsApp +917070022222 to submit your banking disputes.

Q. What can I do if my complaints are not resolved by the HDFC Bank customer representatives?

A. First, lodge a complaint with your regional branch manager or approach the Grievance Officer of the Grievance Redressal Cell (GRC) of HDFC Bank. If the dispute is not resolved within 30 days or dissatisfied with the resolution, escalate the matter with CRN (reference number) to the Nodal Officer of your state or the appointed Principal Nodal Officer (PNO) at the Corporate Office of the bank. You may write a letter, e-mail, or submit the dispute by filing an online complaint.

Q. Where can I approach If not satisfied with the final resolution/response of HDFC Bank Limited?

A. If you are not satisfied with the final order of the Principal Nodal Officer, HDFC Bank, or the dispute is not resolved within 30 days, file a complaint with Banking Ombudsman, RBI against the final order of HDFC Bank. Must mention information with supporting evidence and facts to represent your care transparently and genuinely.